On May 13, 2024, XBP Europe Holdings Inc (XBP, Financial), a leading pan-European integrator of bills, payments, and related solutions, disclosed its financial outcomes for the first quarter ended March 31, 2024, marking its first quarterly report since becoming a public entity. The details of the report can be accessed through the company's 8-K filing.

Company Overview

XBP Europe operates primarily through two segments: Bills and Payments, and Technology. The company specializes in optimizing bill and payment processing across various industries with a significant focus on digital transformation through its proprietary software and services. The majority of its revenue is generated from the Bills and Payments segment.

Financial Performance Insights

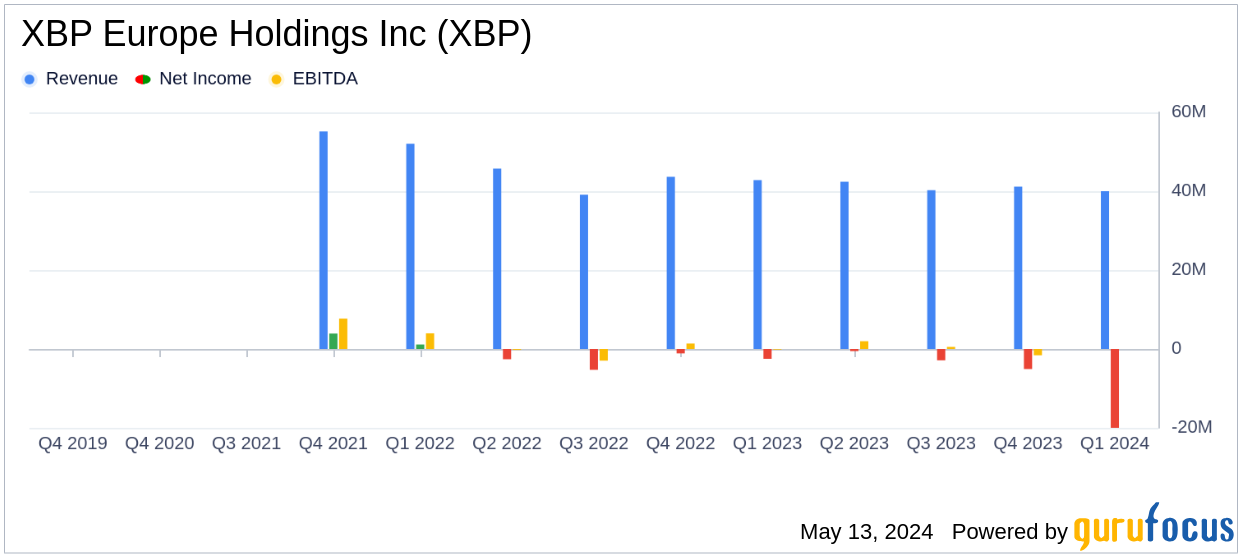

For Q1 2024, XBP Europe reported a net revenue of $40,350 thousand, a decrease from $42,801 thousand in the same period last year. This decline was partially offset by a notable improvement in gross margins due to a better revenue mix and enhanced operating leverage, as highlighted by CEO Andrej Jonovic. He remarked,

Our focus on sales execution is paying off, as evidenced by our recently announced transformation project win for HMPO in the UK."

The Technology segment showed a robust performance with revenues increasing to $11,476 thousand from $9,233 thousand in Q1 2023, underscoring the company's growing emphasis on technology-driven solutions.

Challenges and Operational Highlights

Despite the positive developments in gross margins and technology sales, the overall revenue dip and a net loss of $2,208 thousand compared to a $2,506 thousand loss last year reflect ongoing challenges. These include intense market competition and operational adjustments post their recent public listing. The company's operational efficiency, however, seems to be improving as indicated by the reduced net loss.

Balance Sheet and Cash Flow Analysis

The balance sheet shows a decrease in total assets from $102,739 thousand at the end of December 2023 to $99,135 thousand as of March 31, 2024. This reduction is mirrored in a slight decrease in cash and equivalents, which stood at $3,501 thousand down from $6,905 thousand, indicating a higher cash burn rate which could be a concern if sustained over longer periods.

Cash flows from operating activities also reflected a net use of $3,610 thousand, compared to $4,747 thousand used in the same quarter the previous year, suggesting some level of improvement in managing operational cash outflows.

Strategic Outlook and Investor Notes

Looking ahead, XBP Europe is focused on leveraging its technology segment to drive future growth and improve profitability. The company's strategic initiatives appear aligned with industry demands for digital transformation and efficient payment solutions. Investors and stakeholders are encouraged to view the detailed investor presentation available on the company's website, which outlines further nuances of their financial and strategic positioning.

For more detailed financial information and future updates from XBP Europe Holdings Inc, stakeholders are advised to follow official releases and SEC filings.

Explore the complete 8-K earnings release (here) from XBP Europe Holdings Inc for further details.